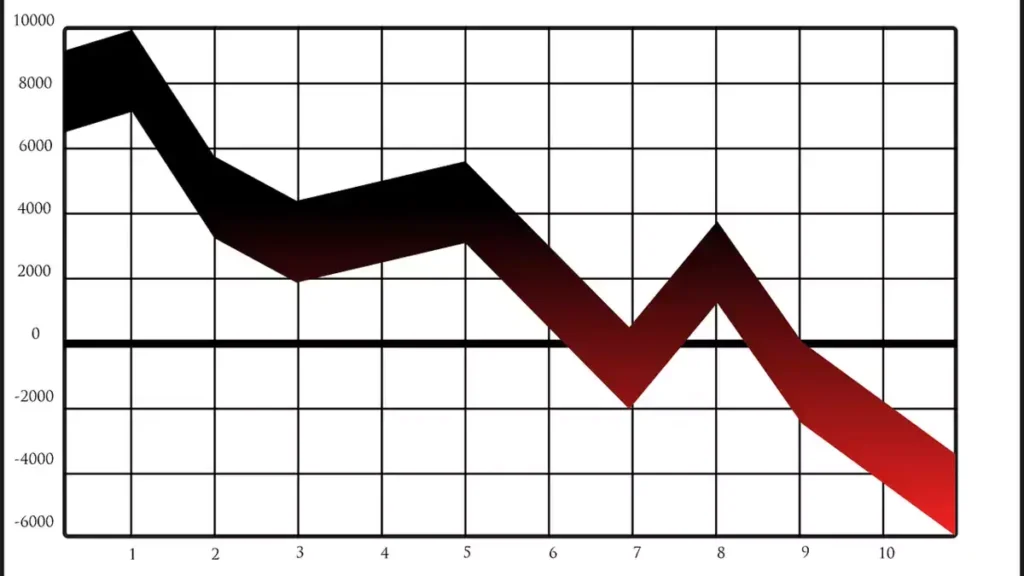

On Thursday, investors moved to withdraw their deposits, which led to a precipitous drop in the price of shares in Silicon Valley Bank (SVB), a significant lender to technology start-ups.

The decline occurred just one day after the Silicon Valley bank announced that it would be selling $2.25 billion worth of shares to help shore up its finances.

Shares of banks have been trading lower all over the world, and the market value of the four largest banks in the United States, including JP Morgan and Wells Fargo, has dropped by more than $50 billion.

The events of the day were described as “wild” and “brutal” by one venture capitalist speaking to the BBC. Friday was a bad day for stock markets across Asia as well, with declines being led by shares of financial companies.

Shares of Silicon Valley Bank experienced their largest one-day decline on record when they fell by more than 60 percent and then lost an additional 20 percent in after-hours trading.

After suffering a loss of approximately $1.8 billion from the sale of a portfolio of assets, the majority of which were US Treasuries, the company decided to begin the share sale.

But what’s more concerning for the bank is the fact that some start-up companies that already have money deposited have been told to withdraw their money.

According to Hannah Chelkowski, founder of Blank Ventures, a fund that wants to invest in financial technology, the current situation is “wild.” This statement was made to the BBC. She is recommending to the companies in her portfolio that they pull their funds.

“It’s incomprehensible how everything could have so swiftly fallen apart. Intriguingly, the bank is the most receptive to working with start-ups. and that it has provided substantial support to start-ups through Covid. Both of these facts combine to make the bank a very attractive option. Now, venture capitalists are advising the companies in their portfolios to withdraw their funds “— I quote her.

She continued by saying, “It’s so cruel.”

Silicon Valley Bank is the banking partner for nearly half of the venture-backed technology and healthcare companies in the United States that were listed on stock markets in the previous year. This makes SVB an essential lender for early-stage businesses.

A request for further comment from the BBC was not immediately met with a response from Silicon Valley Bank. Concerns were raised about the value of bonds held by banks across the wider market because rising interest rates caused the value of those bonds to decrease.

When it comes to fighting inflation, central banks all over the world, including the Federal Reserve in the United States and the Bank of England, have sharply increased interest rates in recent years.

Read Also: Kendall Jenner and Bad Bunny were spotted hugging

Because of the tendency of banks to hold large bond portfolios, these institutions are typically sitting on significant potential losses. The decline in the value of bonds held by banks is not necessarily a cause for concern unless the banks are compelled to sell the bonds.

However, if creditors are forced to sell the bonds they hold at a loss, as was the case with Silicon Valley Bank, this may affect the profits they make.

According to Ray Wang, founder, and chief executive officer of Silicon Valley-based consultancy Constellation Research, who spoke with the BBC, “the banks are casualties of the hike in interest rates.”

“Nobody, not at Silicon Valley Bank nor anywhere else, had the foggiest idea that these loan cost increments would continue for as long as they have up to this point. And I believe that to be the case with what transpired. They lost their wager, “he added.

Silicon Valley Bank stock plunges (Video) Watch Now